According to analysts at Cryptoquant, Ethereum may be on its way to surpass $5,000. Their latest report points to a combination of shrinking supply, rising demand, and network activity as the driving forces behind this potential advance.

Ethereum Supply and Demand Dynamics: Key Indicators of Growth

A December 2024 analysis by Cryptoquant highlights a positive trend for Ethereum. They note that Ethereum’s total supply has reached 120.44 million ETH, the highest level seen since April 2023. However, ETH’s increasing burn rate – mainly from transaction fees – is slowing the overall growth of the supply. Since August 2024, the daily burn rate has skyrocketed, reaching 2,700 ETH in December from 80 ETH. This reduced supply growth is helping to create inflationary pressure on the asset.

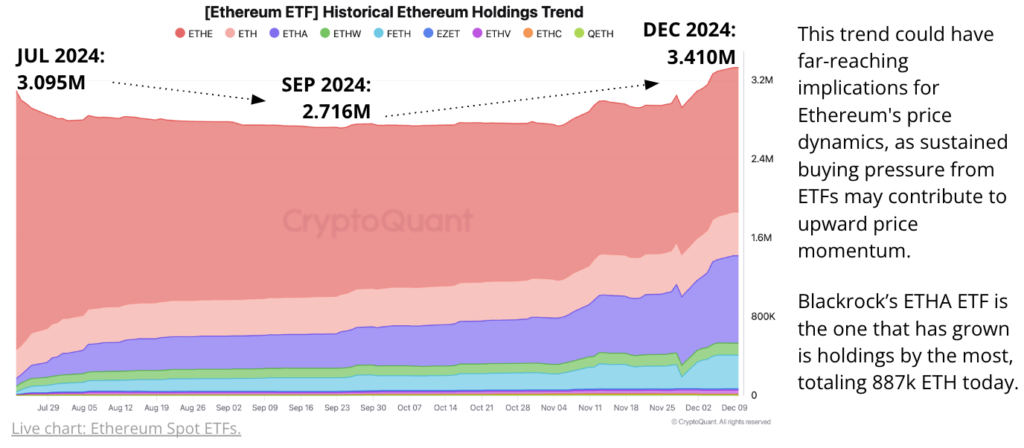

On the demand side, the launch of spot Ethereum exchange-traded funds (ETFs) in the US in mid-2024 has fueled investor interest. Since July, holdings in these ETFs have grown significantly, reaching a peak of 3.41 million ETH — up from 3.095 million ETH. This move is seen as a sign of increasing confidence among institutional and retail investors in Ethereum’s future prospects.

Growing network activity: A sign of growing adoption

Ethereum’s blockchain was also bustling with activity in 2024, with daily transactions between 6.5 and 7.5 million, up from 5 million in 2023. Additionally, contract calls—a key metric for decentralized application (dApp) usage—averaged between 6 and 7.5 million. 7 million per day. This surge reflects the widespread adoption of dApps, pushing more demand into Ethereum’s ecosystem, while also contributing to its inflationary pressure.

Available Price Point $5,200 ETH

A key figure that CryptoQuant points to is Ethereum’s available price, which indicates the average price at which ETH is held. Currently, this metric suggests that Ethereum could reach a valuation as high as $5,200 per ETH. This price range aligns closely with the 2021 bull market, signaling a potential similar bullish cycle for the cryptocurrency.

Final Thoughts

With strong demand, decreasing supply, and a vibrant network, Ethereum is in a favorable position to reach the $5,000 price point. However, CryptoQuant analysts emphasize that sustained investor interest and positive market sentiment will be key to helping Ethereum reach this high valuation level. As decentralized finance (DeFi) and blockchain technology continue to evolve, Ethereum’s role in the cryptocurrency landscape seems to be becoming stronger than ever.